Making over our money, totally

Gregg and I recently made a commitment as a couple and as a family to get out of debt. We have a number of motivating factors for this, but our primary motivation is because the less money we’re paying out to interest payments or what have you, the more we have to help further God’s kingdom.

Gregg and I recently made a commitment as a couple and as a family to get out of debt. We have a number of motivating factors for this, but our primary motivation is because the less money we’re paying out to interest payments or what have you, the more we have to help further God’s kingdom.

We had listened to Dave Ramsey’s radio program for years, so we were already convicted about credit cards and had spent a couple of years getting rid of one after the other. For two Christmases we’ve only spent cash, and despite our family growing from one kid to three in the last three years, we’ve kept the Alero as our primary vehicle until we can pay outright for a minivan.

So, we’ve done things here and there but no real effort.

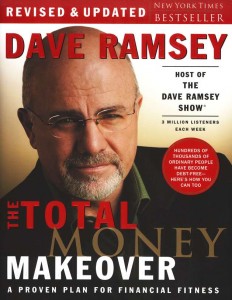

Six months ago, Gregg read Total Money Makeover by Dave Ramsey. We started saving ten percent of his paycheck and tithing, faithfully, another ten percent. That was the easy part.

Gregg then asked me to create a budget for the household. He didn’t want me to include any bills – just what I spend on clothes, shoes, food, gas, etc. Not realizing what I was getting myself into, I put together a very frugal budget. I tried to include anything and everything, including an allotment for birthday presents, writing (I am a writer and there are different costs associated with that), haircuts, and so on. Proud of how frugal I could potentially be, I sent my Excel worksheet complete with spreadsheets and summaries off in an email to him.

A couple of days later, Gregg sent me the account details for my new household checking account along with instructions about using only this account for the household, keeping track of spending, any excess going into savings, etc. And the amount deposited every month? My little frugal budget number or ten percent of my husband’s pay. Whichever is less.

A couple of days later, Gregg sent me the account details for my new household checking account along with instructions about using only this account for the household, keeping track of spending, any excess going into savings, etc. And the amount deposited every month? My little frugal budget number or ten percent of my husband’s pay. Whichever is less.

Wow – that took some discipline. I have always considered myself a smart shopper and a frugal spender, but I didn’t realize until I was extremely limited how MUCH I spent. Once the limiting factor was introduced, once I had to sit down with every receipt and itemize my spending and show a monthly “this is how much I spent on Chik-Fil-A while out shopping with the kids this month,” I just honestly didn’t realize exactly how careless my spending habits were.

Now we’re going through Financial Peace University and learning more and more. We thought the book and the radio program provided enough education, but there is much more meat in the courses. We’re following the steps, our savings continues to grow (despite paying cash to replace the roof and the dining room ceiling last month) and we’re getting rid of that debt in such a snowball that we intend to be able to call his radio program and scream, “WE’RE DEBT FREE!” before the next six months is over.

Hallee

I’m so grateful for your visit, today.

You would bless me if you added me to your

via email.

via email. You can also become a fan on

congrats to you! we will be debt free in about 5 yrs..and we will never again own a credit card!

Are you including your mortgage in your “debt”?

We too pay cash for everything. If we don’t have the money for it, we simply don’t buy it. If we don’t have the money for it in the right “account” then we *might* buy it, but then we have to pay ourselves back. An example of this is our trip out to CA for intense speech therapy for the kids. We got into the program, and felt it was very important for us. So we decided to do it, and go into “debt” to ourselves – but we still paid cash, we just paid out of savings. Now we are working towards paying ourselves back.

We are also working towards paying cash for a minivan in the near future – probably in February or so. That means that the screened-in porch project will have to wait – again. Such is life. I would hate to be in debt and regret my screened in porch. Much better to be debt-free and enjoy my screened in porch. :)

We are not including our mortgage. So, all debt but the mortgage by the end of this year, and then all income can go to savings or mortgage.

It’s awesome that you guys are in such good shape with it!! Very encouraging!